Can I Change My Fsa Contribution During The Year 2025

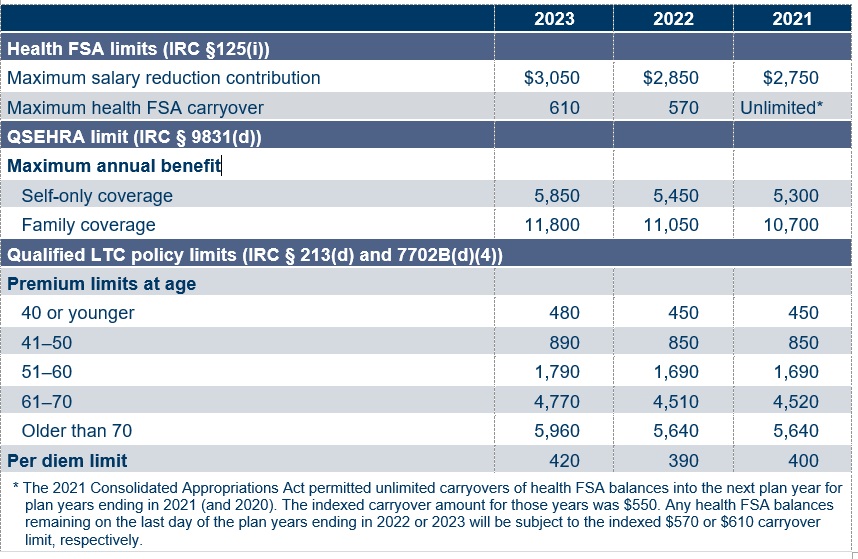

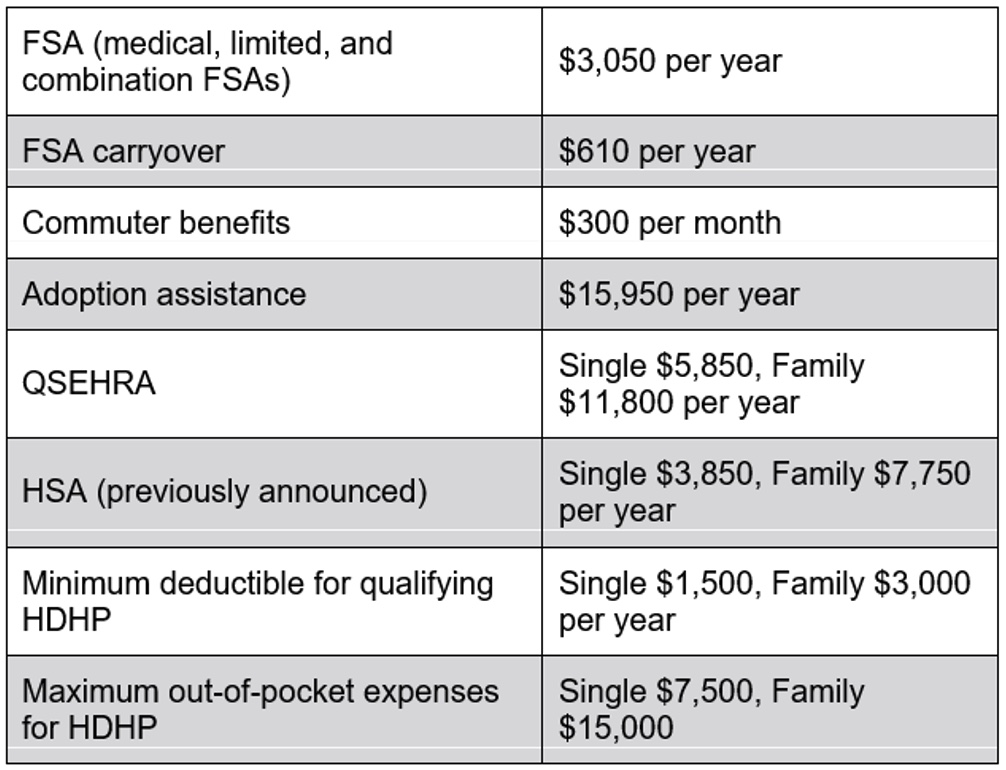

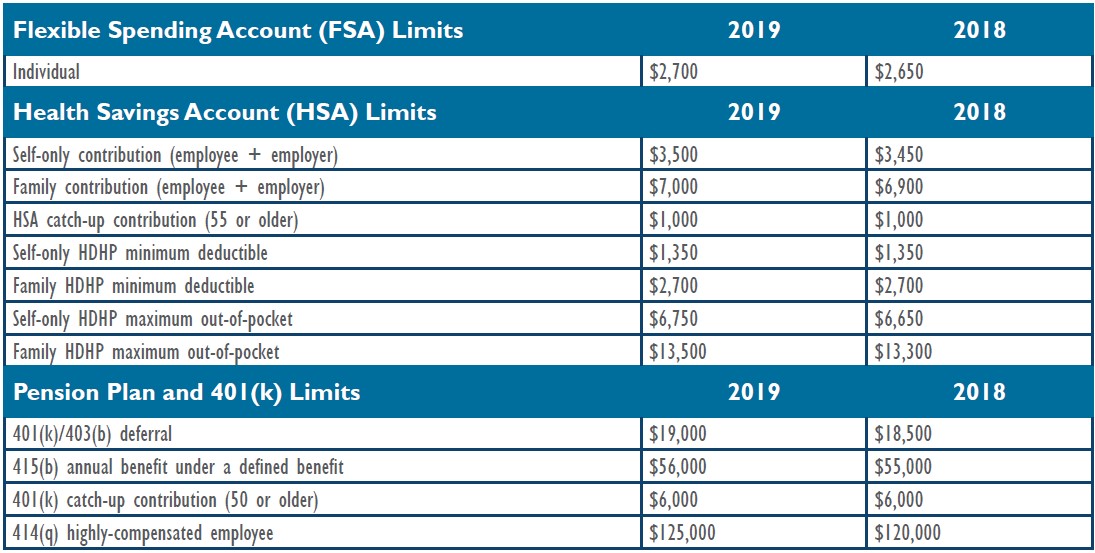

Can I Change My Fsa Contribution During The Year 2025. As a rule, you can’t change your health care fsa (hcfsa), limited expense health care fsa (lex hcfsa), or dependent care fsa (dcfsa) election amount during a benefit period (the. The irs announced the 2025 contribution limits for all flexible spending account (fsa) plans.

Flexible spending account contribution limits are set annually by the irs, and an employer can choose to set a lower limit. The 2025 fsa contribution limits are finally here.

Can I Change My Fsa Contribution During The Year 2025 Images References :

Source: sarahshort.pages.dev

Source: sarahshort.pages.dev

Family Fsa Contribution Limit 2025 Sarah Short, If the fsa plan allows unused fsa amounts to carry.

Source: alexanderhughes.pages.dev

Source: alexanderhughes.pages.dev

Dependent Care Fsa Contribution Limit 2025 Lok Slexander Hughes, The irs announced the 2025 contribution limits for all flexible spending account (fsa) plans.

.png) Source: jasmineparsons.pages.dev

Source: jasmineparsons.pages.dev

Max Fsa Contribution 2025 Family Jasmine Parsons, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2024 plan year.

Source: colinallan.pages.dev

Source: colinallan.pages.dev

2025 Fsa Contribution Limits Family Of 4 Colin Allan, The maximum carryover amount to 2025 is $660.

Source: www.pinterest.com

Source: www.pinterest.com

How do I contribute to my FSA? Vision insurance, Contribution, Ways, The fsa contributions limit for 2025 is $3,300, that’s up from $3,200.

Source: davidalsop.pages.dev

Source: davidalsop.pages.dev

Fsa Maximum Contribution 2025 David Alsop, The irs announced the 2025 contribution limits for all flexible spending account (fsa) plans.

Source: isaacgray.pages.dev

Source: isaacgray.pages.dev

Fsa Contribution Limits For 2025 Rollover Isaac Gray, If you have an fsa account, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2026).

Source: www.differencecard.com

Source: www.differencecard.com

What are Qualifying Life Events & How do they Affect my FSA?, In 2025, workers can add an extra $100 to their fsas as the annual contribution limit rises to $3,300 (up from $3,200).

Source: sehp.healthbenefitsprogram.ks.gov

Source: sehp.healthbenefitsprogram.ks.gov

IRS Announces 2024 Increases to FSA Contribution Limits SEHP News, The maximum carryover amount to 2025 is $660.

Source: philhamilton.pages.dev

Source: philhamilton.pages.dev

Fsa Contribution Limits 2025 Phil Hamilton, Now you're wondering if you can change your fsa contributions.